1099-k paypal gambling|received 1099 k from paypal : Bacolod It's unclear if PayPal is required to issue a 1099-K in this case, because the payments are coming from someone who will already be issuing a W-2G (assuming it is a gambling operation that complies with US tax law.) You are only required to report your . In this post, we will show you how to fix Realtek Audio Universal Service issues by reinstalling the Realtek HD Universal Service driver or updating the Realtek HD Universal Service driver. There are also some other solutions you can try. Free Download Realtek Audio Console for Windows 10/11.

1099-k paypal gambling,It's unclear if PayPal is required to issue a 1099-K in this case, because the payments are coming from someone who will already be issuing a W-2G (assuming it is a gambling operation that complies with US tax law.) You are only required to report your .It's unclear if PayPal is required to issue a 1099-K in this case, because the .The TurboTax community is the source for answers to all your questions on a range .

Create an account - If I have been using PayPal to withdraw gambling winnings, I .My client received a 1099-K from Paypal for online gambling. He said the amount . Yes, you need to report gambling winnings from form 1099-K. You may only deduct gambling losses, to the extent of gambling winnings. The gambling losses will be on Schedule A, if you itemize .

Yes, you need to report your 1099-K for your gambling winnings. Although usually gambling winnings are reported on the form W-2G, you received a form 1099-K . How are gambling winnings taxed? Do sportsbooks and casinos report gambling winnings to the IRS? Are gambling winnings taxed on both the federal and state level? How to report your gambling .

More information about reliance is available. IRS-FAQ. Page Last Reviewed or Updated: 05-Dec-2023. IR-2022-230, December 28, 2022 — The Internal Revenue .1099-k paypal gambling More information about reliance is available. IRS-FAQ. Page Last Reviewed or Updated: 05-Dec-2023. IR-2022-230, December 28, 2022 — The Internal Revenue .

received 1099 k from paypal More information about reliance is available. IRS-FAQ. Page Last Reviewed or Updated: 05-Dec-2023. IR-2022-230, December 28, 2022 — The Internal Revenue .1099-k paypal gambling received 1099 k from paypal More information about reliance is available. IRS-FAQ. Page Last Reviewed or Updated: 05-Dec-2023. IR-2022-230, December 28, 2022 — The Internal Revenue .

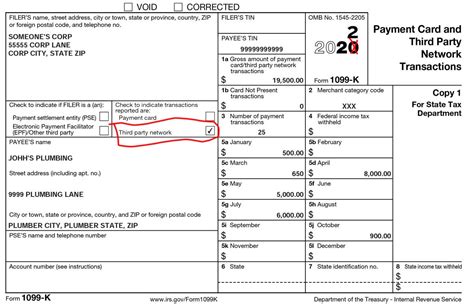

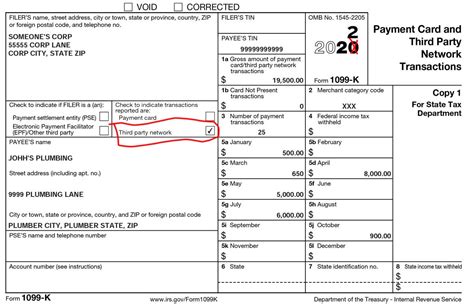

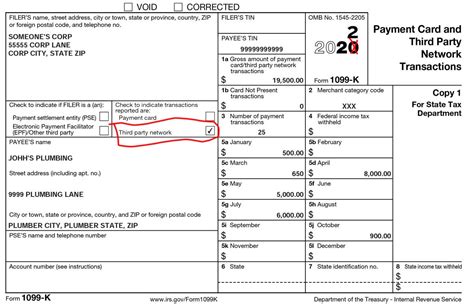

If a taxpayer receives winnings through cash applications such as PayPal or Venmo, they may receive a Form 1099-K: Payment Card and Third-Party Network .WEBPayPal prohibits transactions for gambling activities by merchants and account holders in the U.S. and any jurisdiction where gambling activities are illegal, and by . What is a PayPal 1099-K Form? Form 1099-K is an Internal Revenue Service (IRS) tax form used by third-party payment platforms like PayPal, Cash App and Venmo .

1099k from Paypal, gambling transaction questions @ spiff1972. The computation is performed on the federal return and as a result, the information accurately rolls to the state return. . Description -something like -1099-K duplicate; Amount, enter your amount as a negative; continueWEBHere’s how to view or download your Form 1099-K from a web browser: Click Settings next to “Log out.”. Click Statements and Taxes near the top of the page. Under the “Tax Documents” section, select the year you need from the dropdown. Click Download all to download and view both your Form 1099-K and your Goods and Services .

Update November 30, 2023. The IRS has recently announced an additional delay in implementing the $600 reporting threshold for goods and services transactions, reverting the 2023 requirement for Form 1099-K reporting back to the 2022 figures (total payments exceed $20,000 USD and there are more than 200 transactions). This means .

Online betting sites may issue a Form 1099-MISC, or if you receive your winnings through third-party payment apps such as PayPal, Venmo, or CashApp, you may receive a Form 1099-K. Receipt of these forms should be your clear signal that you’ve been dealt a taxable event. . gambling winnings are reported on one part of your tax return . Online gaming forums have a legal obligation to report annual winnings of at least $600 on Form 1099-MISC. If you’re paid through a third-party source, such as PayPal or Venmo, you’ll receive a 1099-K. The IRS will also receive copies of these forms and may flag your return if you don’t report the income. Even if you don’t receive any .WEBAny gambling winnings and losses while playing online are reportable and potentially taxable, but deposits and withdrawals are transfers of capital, not subject to tax. It's unclear how the amounts reported on the 1099-K from Paypal were reported, but they should have been shown on your tax return as nontaxable transactions. IRS updates frequently asked questions about Form 1099-K. IR-2022-230, December 28, 2022. WASHINGTON — The Internal Revenue Service today updated frequently asked questions (FAQs) for Form 1099-K, Payment Card and Third Party Network Transactions, in Fact Sheet FS-2022-41 PDF. The updates include: I have a 1099-K from PayPal from Online Gambling or Draft Kings, that shows I have income of 47K because that is what I withdrew from PayPal back to my account. The 1099-K does not account for what I deposited into Draft Kings, which was a total of 71,610. Which means I actually lost money on the year, but my taxes are .

WEBPaypal 1099-K and gambling "income". I received a 1099-K from Paypal despite not owning a business or being self employed. It was mostly random things I sold (at a loss) on reddit and eBay. I've done a decent amount of research on that topic, and it seems I do not have to report that because it was not truly "income". 1099-K is an income summary that payment processors like PayPal send to anyone who receives receives a certain amount in business transactions through the platform. For the 2023 tax year, PayPal is only required to send you a 1099-K if you: Made at least $20,000 in sales on the platform. Had at least 200 business transactions. 1099 and Online Casino Gambling. Feb-03-2019 12:01 AM. I was a fool last year and spent a lot of money on online gambling. I am dealing with my addiction demons and have left that life behind, but I am now dealing with the debris of those bad choices at tax time. I lost $60,00 last year, but I am alive and moving forward in recovery. Re: PayPal 1099–k for online gambling. by rkhusky » Sat Mar 19, 2022 12:37 pm. As mentioned in the above link, the 1099-K reports cash flow, not profit/loss or income/expenses. You use info from the 1099-K to compute the latter. Here's a link from the IRS on reporting gambling gains/losses:

WEBPayPal 1099-K for online gambling. Unsolved. I received a 1099-k from Paypal as withdrawals from the casino were counted as payments to me. This is the total withdrawal amount for the year and does not include any of the deposits. The deposits exceed the withdrawals but I'm not sure how to go about filing this or demonstrating this. PayPal and Venmo are common examples of third-party networks. When you receive a copy of your 1099-K form, you’ll see an aggregate total of money received through the payment network for the tax .WEBWhat is the 2023 Form 1099-K IRS tax reporting threshold on PayPal? The IRS has recently announced an additional delay in implementing the new $600 USD reporting threshold for goods and services transactions, reverting the 2023 requirement for Form 1099-K reporting back to the 2022 figures (total payments exceed $20,000 USD and . The American Rescue Plan Act of 2021 changed the minimum reporting threshold for certain transactions. The IRS planned to require services like Cash App for Business to report payments for goods and services on Form 1099-K when those transactions total $600 or more in a year, starting January 2022. On November 21, . Just like any other form of income, gambling winnings are taxable. This applies to all types of gambling, whether you placed your bet in person, on an app, or on your computer. . However, if you received your payouts from third-party payment platforms like Stripe or PayPal, you may receive a 1099-K — which reports payments from credit .

1099-k paypal gambling|received 1099 k from paypal

PH0 · when do casinos issue 1099s

PH1 · received 1099 k from paypal

PH2 · draftkings withdrawal to paypal

PH3 · draft kings paypal withdraw

PH4 · do casinos send 1099

PH5 · Iba pa

PH6 · 1099k paypal turbotax

PH7 · 1099 sports betting

PH8 · 1099 k for gambling